Homechoice International plc becomes Weaver Fintech Ltd – cements evolution to a fintech business.

Mauritius, 23 July 2025: Weaver Fintech Ltd is the new name of Homechoice International plc, which today begins trading on the Johannesburg Stock Exchange (JSE) as WVR (formerly HIL). The change of name underscores the continued growth and profitability of the group’s fintech business and represents the group’s core operations and future strategic positioning.

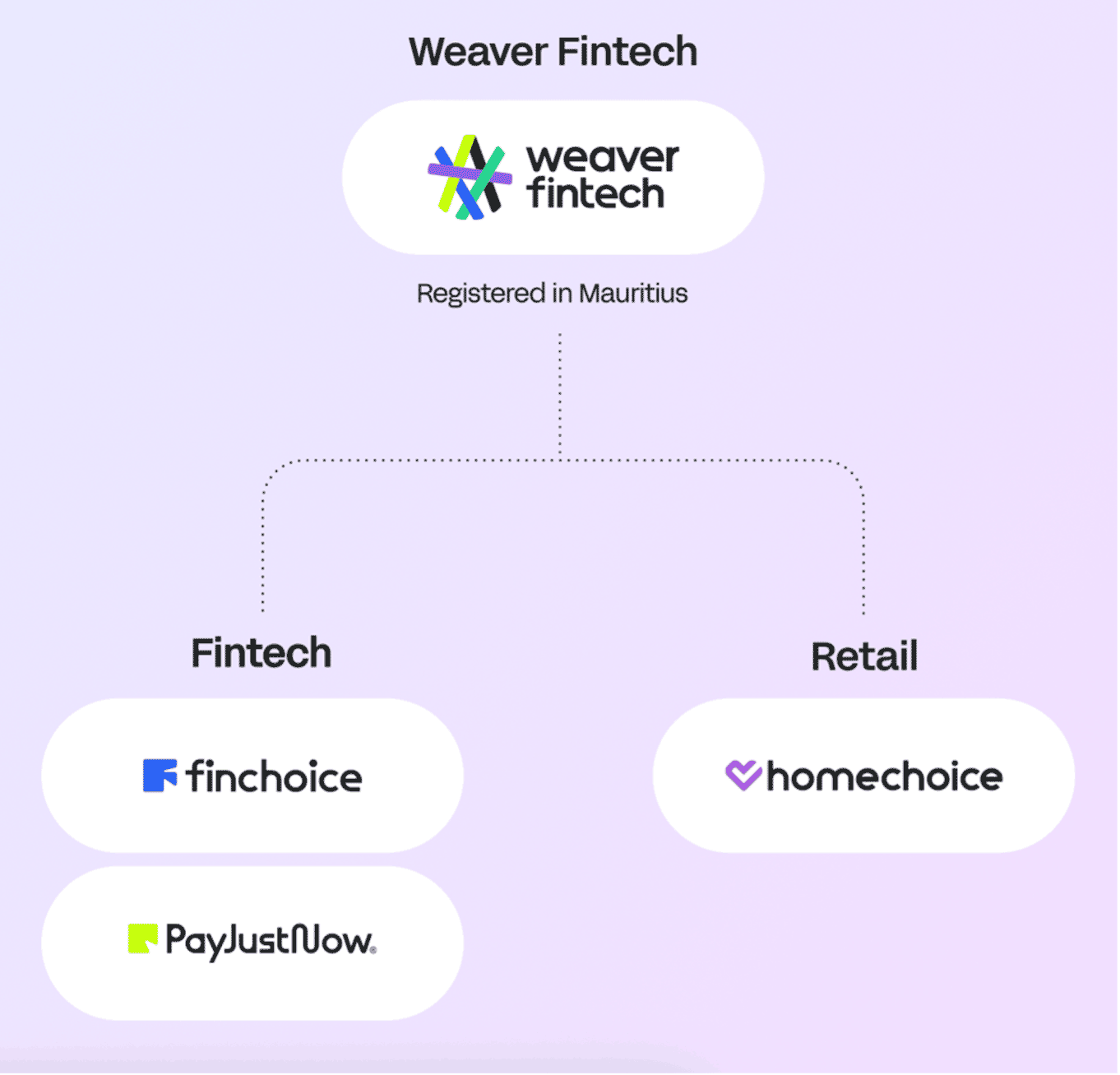

The Weaver Fintech Ltd group comprises the fintech business with its FinChoice and PayJustNow brands, as well as the retail business, which trades as Homechoice.

The group’s name-change marks the next milestone in a 40-year journey that began in 1985, with the establishment of Homechoice as a direct-marketing homewares retailer, pioneering access to credit in underserved markets. The group has since evolved to become a profitable, high-growth fintech business which is now the primary driver of group performance and profit before tax. In the group’s FY2024 annual report, the fintech business was responsible for more than 90% of group profits, maintaining consistent revenue and profit CAGRs of more than 30% for the past five years.

With a customer base of over 3 million and a growing network of more than 3,000 merchants, Weaver Fintech provides payments, lending and insurance through its digital ecosystem. The growing, symbiotic relationship between customers and merchant partners continues to create a significant opportunity to expand. “Rooted in digital innovation, customer-centricity and financial inclusion, Weaver Fintech Ltd is intent on reshaping the financial landscape by providing South Africans with tools that empower them to better their lives and their communities.” says Sean Wibberley, CEO of Weaver Fintech Ltd.

Weaver Fintech Ltd’s fintech business operates across three verticals: payments, lending and insurance. Customer acquisition typically begins through Weaver’s digital payment products, including PayJustNow’s market-leading interest-free buy now pay later product and the PayStretch product for higher value purchases over a longer repayment period. Once they are engaged in the ecosystem, they can access further financial services easily and efficiently.

FinChoice’s credit-backed wallet, MobiMoney, is the cornerstone of the lending vertical. FinChoice offers personal loans from 6 to 36 month terms, and will soon include a virtual card, reinforcing the digital nature of the Weaver Fintech ecosystem. Insurance solutions are offered digitally or embedded in-flow.

“We’ve built a trusted digital ecosystem, with products and services that work seamlessly together, providing smart, simple financial solutions for customers and merchants” says Wibberley. “This rebrand is more than a name change; it’s a signal of our fintech commitment and intent to customers and the market.”

-ends-

About Weaver Fintech Ltd

Weaver Fintech Ltd (Weaver) is a fintech and omni-channel retail group, serving over 3.1 million customers across South Africa. The group offers a digital fintech ecosystem of payments, lending, and insurance solutions – through its PayJustNow and FinChoice brands – as well as innovative retail products from Homechoice. Weaver is committed to financial inclusion, empowering consumers through responsible credit and technology-driven financial services. The Group’s customer-centric approach ensures long-term financial wellness for its customers, while its investments in technology and data analytics enable seamless, intuitive, and personalised financial solutions. As Weaver continues to expand, its focus on digital transformation and financial inclusion will remain at the forefront of its growth strategy. www.weaverfintechcom (JSE: WVR)

Note to Editor

Herewith the structure of the Weaver Fintech Ltd group: